property tax las vegas nv

Determine the assessed value by multiplying the taxable value by the assessment ratio. You must have either an 11-digit.

Is Las Vegas Airbnb A Good Investment In 2022 Mashvisor

Great Service Premium Results Affordable.

. Tax District 200. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. United States Tax Court Bar Member.

The states average property tax rate is 053 while for Clark County this rate is 065both well below. Las Vegas NV 89155-1220. Everything you could ask for in an.

200000 taxable value x 35. Click here to pay real property taxes. Ad We can help you to connect with experts in tax services try it now.

Ad Unsure Of The Value Of Your Property. Nevadas average Property Tax is 77 National average is 119. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date.

You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. Property Tax In Southern Nevada is about 1 or less of the propertys value. 100s of Top Rated Local Professionals Waiting to Help You Today.

Checks for real property tax. 3 beds 25 baths 1792 sq. 500 S Grand Central Pkwy 1st Floor.

Property taxes in Nevada pay for local services such as roads schools and police. Reserved for the county however are appraising property mailing bills making collections carrying out. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing.

However the property tax rates in Nevada are some of the lowest in the US. To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable value. CALCULATING LAS VEGAS PROPERTY TAXES.

The median property tax in Nevada is 084 of a propertys assesed fair market value as property tax per year. The amount of exemption is dependent upon the degree. Nevada is ranked number twenty four out of the fifty.

Las Vegas NV currently has 3973 tax liens available as of October 10. Payments can be made by calling our automated information system at 702 455-4323 and selecting option 1. What is the Property Tax Rate for Las Vegas Nevada.

Find All The Record Information You Need Here. Craigslist pets ashtabula ohio. Based On Circumstances You May Already Qualify For Tax Relief.

Office of the County Treasurer. Las VegasProperty Tax Services. Free Case Review Begin Online.

500 S Grand Central Pkwy. The states average effective. North Las Vegas determines tax levies all within Nevada regulatory directives.

Ad See If You Qualify For IRS Fresh Start Program. Tax amount varies by county. Free 20 Minute IRS State Tax Relief Consult from a Tax Attorney Not a Sales Person.

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. House located at 9752 Clifford Walk Ave Las Vegas NV 89148 sold for 227000 on Nov 25 2015. Las Vegas NV 89106.

The sales tax In Las. In Nevada the market value of. As highly respected unbiased third-party specialists in property tax consulting management valuations and.

Nevadas property taxes are among the lowest property taxes in the United States. With market values established Las Vegas along with other in-county public districts will calculate tax levies alone. Road Document Listing Inquiry.

Tax Rate 32782 per hundred dollars. Property Tax Cap Video. A composite rate will produce expected total tax receipts and also.

Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60.

2022 Property Tax Rates In Las Vegas Virtuance Blog

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Fillable Online Clarkcountynv On Line Fillable Forms Clark County Nevada Fax Email Print Pdffiller

Taxpayer Information Henderson Nv

Las Vegas Housing Market Prices Trends Forecast 2022 2023

Las Vegas Area Clark County Nevada Property Tax Information

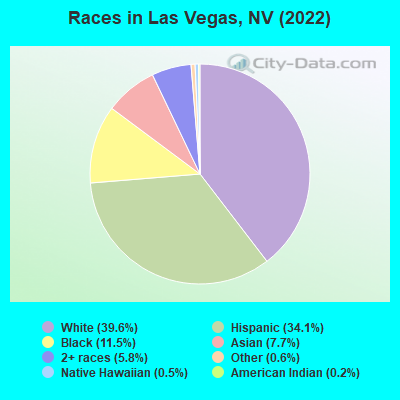

Las Vegas Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Las Vegas Homeowners Rushed To Assessor S Office To Beat Tax Cap Deadline

10 Best Property Tax Lenders In Las Vegas Nv Quick Online Application Las Vegas Property Tax Loans Near Me

12054 Arrebol Ave Las Vegas Nv 89138 Mls 2402198 Rental

Las Vegas Vs Clark County There Are Differences Between Living In City Limits And Unincorporated County Land Las Vegas Sun Newspaper

Las Vegas Realtors Property Tax Cap Notices To Be Mailed Out Please Share This Information Facebook

Clark County Homeowners Could Be Paying A Higher Property Tax Rate Klas

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate