tesla model y tax credit california

Tags Model Y tax tax credit upgrade E. Make sure your financial situation is healthy.

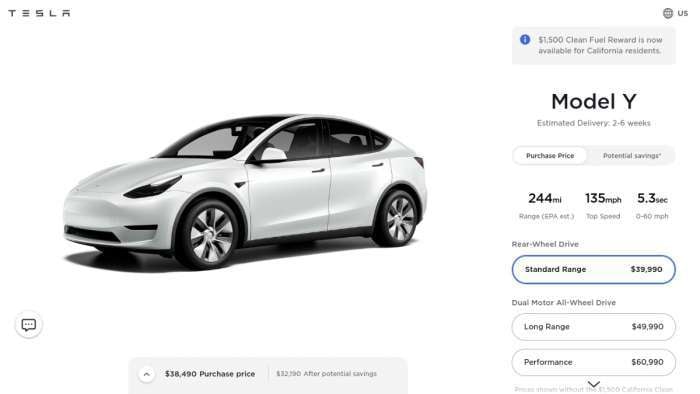

Tesla Hikes Price Of Model 3 Model Y By 2 000

This happened in 2018 and all new Teslas bought through the end of 2018 qualified for the 7500 tax credit.

. TSLA CEO Elon Musk predicted the Model Y could become the bestselling vehicle worldwide by 2023. When approved youll get a check of 2000 in your mailbox simple and straight. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

Start date Dec 29 2021. Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31 2020. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform.

E-tron Sportback 2020-2022 7500. Theres also a tax credit of up to 75 for installing electric vehicle supply equipment or EVSE in your house or housing unit. And 300000 for joint.

Sawyer Merritt SawyerMerritt November 19 2021. Electrek noticed that Tesla has increased the price of the Model Y by 1000. Posted by 14 hours ago.

If California is any indication Musks. 2500 tax credit for purchase of a new vehicle. Q4 50 e-tron Quattro.

This is not the end of Cali perks theres another grant named the California Clean Vehicle Rebate Project CVRP and luckily Tesla Model Y and Model 3 both are on the eligible vehicle list. However Teslas can still qualify for up to 7500 in tax credits. 45 rows Make Model PHEV or BEV Federal Tax Credit As of Jan 1 2020.

Are Any Other Manufacturers Close to. Tax Credit Model Y. This is an additional 2000 rebate for which you can apply online.

Tesla Inc NASDAQ. California California gives 2000 to 4500 in rebates for buying a Tesla Model 3 and Model Y depending on your income. 204000 for heads of household.

Dec 29 2021 2 0 Ceres ca. Today the only car that would qualify for anywhere near the full proposed 12500 EV tax credit is the Chevrolet Bolt EV and Bolt EUV. Most commonly this means having an electric car charging station at your home.

1500 tax credit for lease of a new vehicle. Tesla Model 3Y would get 8000 and Ford Mach-E would get 8000. Tesla and GM are set to.

Since the new law would take the tax credits off the price of an EV at the time of purchase Tesla is making moves to get more money upfront from its customers before getting the rest from Uncle Sam. E-tron SUV 2019 2021-2022 7500. Discuss Teslas Model S Model 3 Model X Model Y Cybertruck Roadster and More.

Since 2010 California has handed out 809 million of taxpayer money to put 354000 battery-electric plug-in hybrid and hydrogen fuel-cell cars on public roads. Big Lots to offer most comprehensive Presidents Day furniture deals ever. It phased out in 2019 first reducing to 3750 and then to 1875.

Siemens agrees to sell logistics business to Koerber in 115 bln euro deal. Sometimes the best decision is to do nothing at all. Dec 29 2021 1 Dec 29 2021 1 Im upgrading from a Model 3.

A nonrefundable credit is an amount that only goes towards the tax payers tax liability. 11th 2021 622 am PT. Make and Model.

This program is limited to eligible vehicles and only applies to consumers under the specified income threshold 150000 for single filers. This value cannot exceed 5000 thus limiting the total credit to 7500. Note that the CVRP rebate is not a tax credit.

Unlike the Federal EV tax credit where you must file your taxes to get the credit the CVRP program just sends you a check when you fill out the application I would be interested to know if there are any tax incentives which we would also be eligible for in CA either related to the purchase of the vehicle or installation of a. I have a. Select utilities may offer a solar incentive filed on behalf of the customer.

Cancelled the Tesla to save my bread until I can afford it in cash. Menu We are. E-tron GT RS e-tron GT 2022 7500.

This tax credit begins to phase out once a manufacturer has sold 200000 qualifying vehicles in the US. For Teslas bought on or after January 1 2020 there has been no federal tax credit. Of that number Tesla owners.

Teslas Model Y Is Taking Over California The Largest Auto Market In The US. California residents who purchase or lease a new battery plug-in hybrid or fuel cell electric vehicle may be eligible for a rebate of up to 7000. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit.

It turns out that theres another grant named the California Clean Vehicle Rebate Project CVRP and luckily Tesla Model Y and Model. Main Business Finance News Today. Approved for financing and everything but the new rates make it so I have to spend 6000 more to buy the car.

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Continouing with its price cuts Tesla has once again lowered the price of the Model 3 Y. 2 days ago2020 Chevy Silverado 2500 2020 Ford F-Series Super Duty 2020 Mazda CX-9 2020 Hyundai Sonata 2020 Toyota 4Runner Tesla Model 3 Best Cars All the best cars.

Latest On Tesla Ev Tax Credit January 2022

Teslas Just Got 1 500 Less Expensive In California Carbuzz

Tesla Model Y Number One Luxury Compact Suv In California Torque News

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Tesla S 4th Quarter Registrations In California Up Almost 63 Cleantechnica